JMP - Long run carbon consumption risks and asset prices

Working paper, 2021

Motivation

- FIRST

- Environnemental issues

- Consumption of goods and services pollutes the environnement ;

- Production vs. consumption-based CO2 emissions (GCP). Fact

- Despite that, most papers and climate policies focus on the production side.

- SECOND

- Climate change is a long horizon phenomenon ;

- Need a long-run risk model to assess it ;

- Yet, the effect of the canonical long-run risks on the assets depends on investors detecting it ;

- Require a new LRR model by considering carbon emissions consumption.

- However, emission does have long-run risk and is more detectable :

- Curbing carbon emissions at the pre-industrial level ;

- Emission $\rightarrow$ Damages $\rightarrow$ affects aggregate consumption.

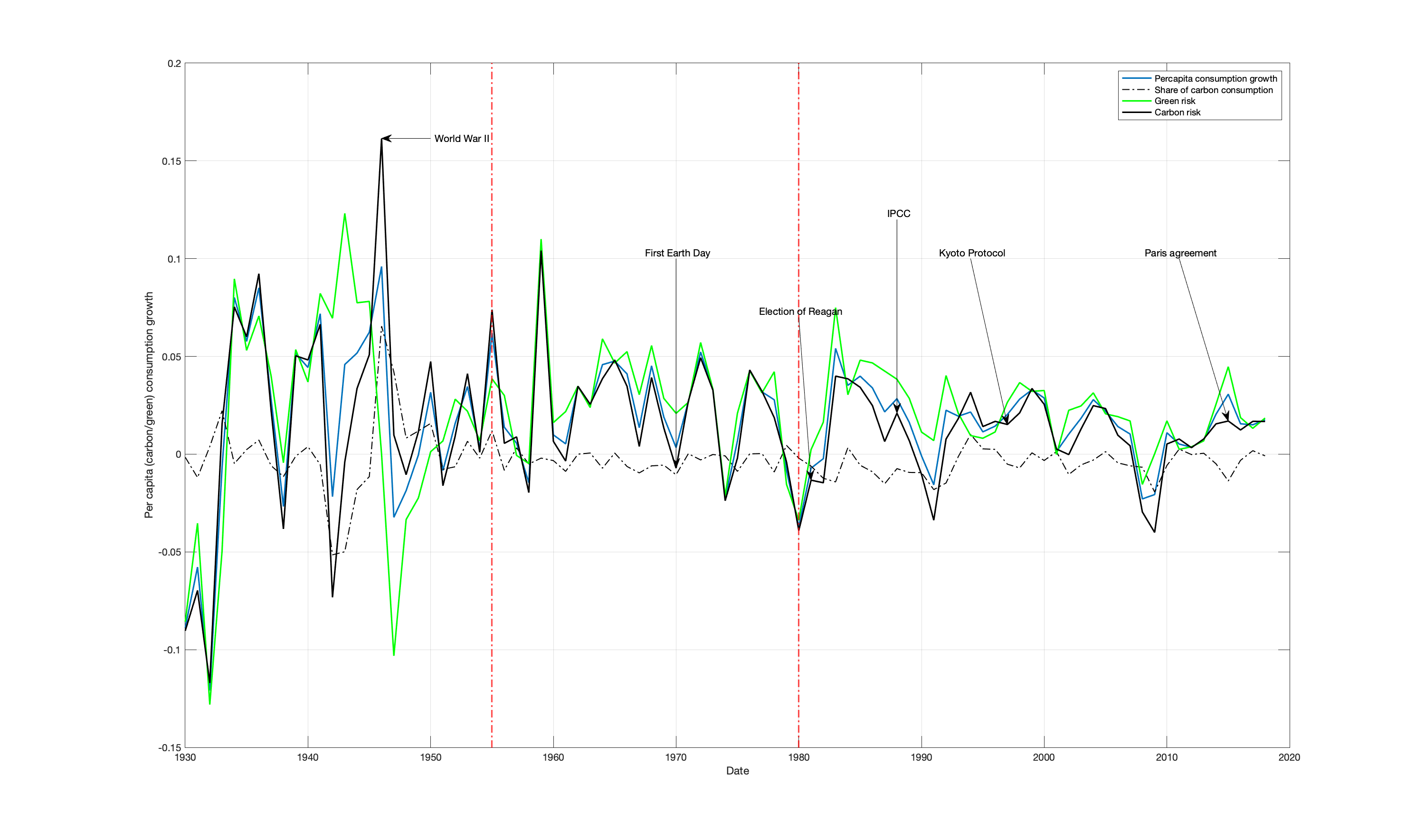

Data

Model

Long-run carbon consumption risks model

- Consumption growth decomposition :

- Carbon consumption growth dynamic :

- Conditional expectation of carbon consumption growth dynamic :

- Conditional volatilty of carbon consumption growth dynamic :

- Share of carbon consumption out of total consumption growth dynamic :

- Dividend of any asset i growth dynamic :

Where $\epsilon_{x, t+1}, \epsilon_{cc, t+1}, \epsilon_{\alpha, t+1}, \epsilon_{i, t+1}$ and $\epsilon_{\sigma, t+1}$ are i.i.d.

Findings

- LRCCR model replicates the equity premium, volatility and risk-free rate much better than LRR :

- By decomposing consumption growth into two components ;

- Long-run risks in both expected carbon consumption and volatility.

- My LRCCR model increases the capacity to detect the long-run risk during the period 1956-2018. But during the period 1930 - 1955, it was less dectectable :

- Investors can profit from it using climate change news ;

- The long-run risk variable $x_t$ and its conditional variance $\sigma _t ^2$ help improving the predictability of the equity premium and the consumption growth.